Some Known Facts About Feie Calculator.

4 Simple Techniques For Feie Calculator

Table of ContentsFeie Calculator Fundamentals ExplainedOur Feie Calculator StatementsSome Known Details About Feie Calculator More About Feie CalculatorOur Feie Calculator Diaries

Initially, he offered his U.S. home to develop his intent to live abroad permanently and made an application for a Mexican residency visa with his other half to aid fulfill the Bona Fide Residency Examination. Additionally, Neil protected a long-lasting residential property lease in Mexico, with plans to eventually purchase a residential or commercial property. "I currently have a six-month lease on a residence in Mexico that I can prolong another six months, with the objective to purchase a home down there." Nevertheless, Neil mentions that acquiring building abroad can be testing without very first experiencing the location."We'll definitely be outdoors of that. Also if we return to the US for doctor's appointments or company calls, I doubt we'll invest even more than 1 month in the US in any kind of offered 12-month period." Neil stresses the relevance of strict monitoring of U.S. check outs (American Expats). "It's something that individuals require to be truly persistent about," he claims, and encourages expats to be mindful of common errors, such as overstaying in the U.S.

The Feie Calculator PDFs

tax obligations. "The reason that united state tax on globally earnings is such a large bargain is due to the fact that lots of people forget they're still subject to united state tax even after transferring." The united state is among the few countries that taxes its citizens no matter where they live, implying that also if an expat has no earnings from united state

tax return. "The Foreign Tax Credit scores allows individuals operating in high-tax countries like the UK to offset their U.S. tax obligation liability by the quantity they've currently paid in taxes abroad," says Lewis. This guarantees that deportees are not exhausted twice on the very same income. However, those in reduced- or no-tax nations, such as the UAE or Singapore, face additional hurdles.

All About Feie Calculator

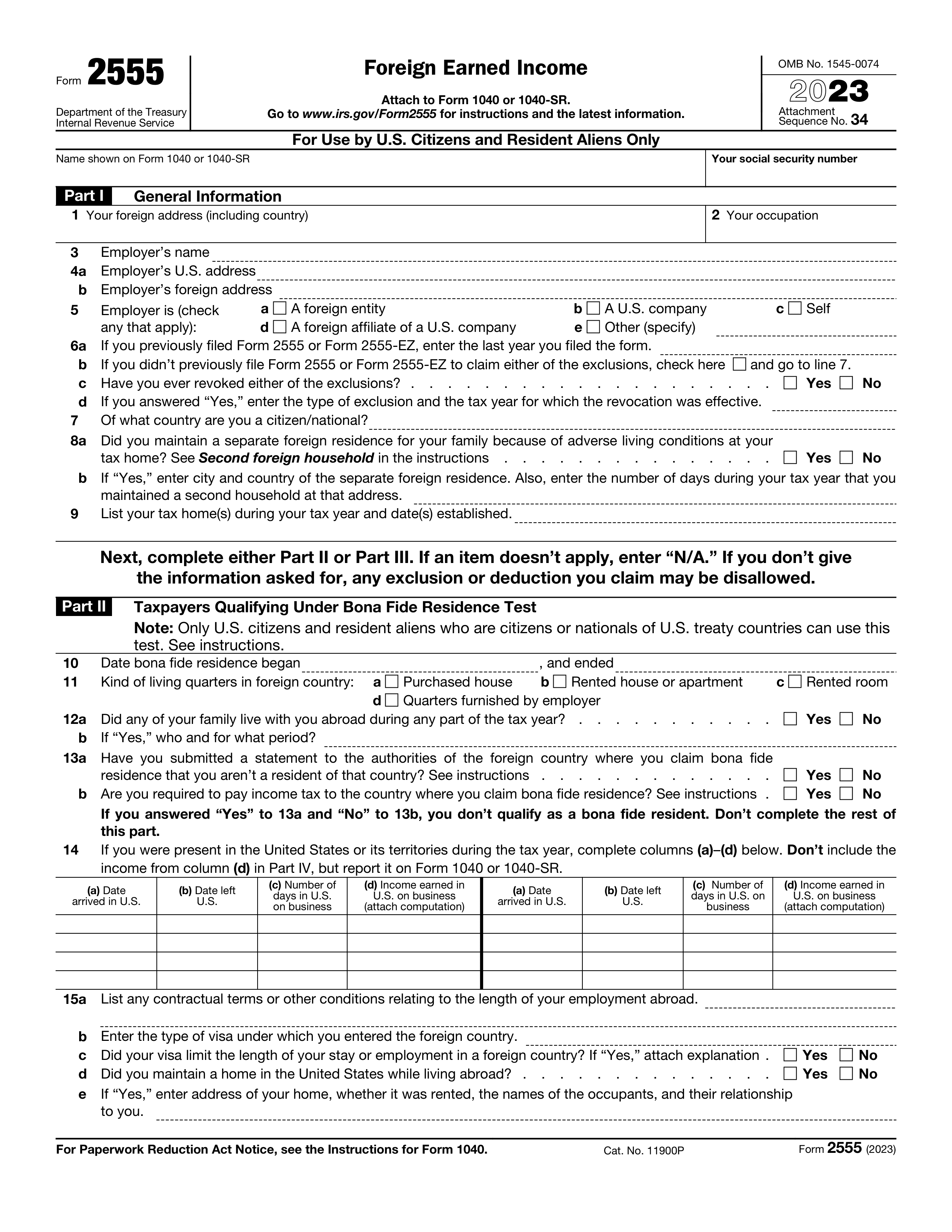

Below are several of the most frequently asked inquiries concerning the FEIE and various other exemptions The Foreign Earned Income Exemption (FEIE) permits united state taxpayers to omit approximately $130,000 of foreign-earned revenue from government revenue tax, lowering their U.S. tax obligation obligation. To certify for FEIE, you have to fulfill either the Physical Visibility Examination (330 days abroad) or the Authentic Residence Examination (confirm your key house in a foreign country for an entire tax year).

The Physical Existence Test requires you to be outside the U.S. for 330 days within a 12-month period. The Physical Presence Examination additionally needs united state taxpayers to have both a foreign income and an international tax obligation home. A tax obligation home is defined as your prime place for company Read Full Article or work, despite your household's house.

Excitement About Feie Calculator

An income tax treaty in between the U.S. and one more nation can help stop double tax. While the Foreign Earned Revenue Exclusion minimizes taxed earnings, a treaty might supply fringe benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Report) is a needed declare U.S. residents with over $10,000 in international financial accounts.

Qualification for FEIE depends upon meeting particular residency or physical existence examinations. is a tax obligation advisor on the Harness platform and the owner of Chessis Tax. He is a member of the National Association of Enrolled Professionals, the Texas Culture of Enrolled Agents, and the Texas Society of CPAs. He brings over a years of experience helping Large 4 companies, recommending migrants and high-net-worth people.

Neil Johnson, CPA, is a tax obligation advisor on the Harness platform and the owner of The Tax Man. He has more than thirty years of experience and currently concentrates on CFO solutions, equity payment, copyright taxes, cannabis taxation and divorce related tax/financial preparation issues. He is an expat based in Mexico - https://feie-calculator.webflow.io/.

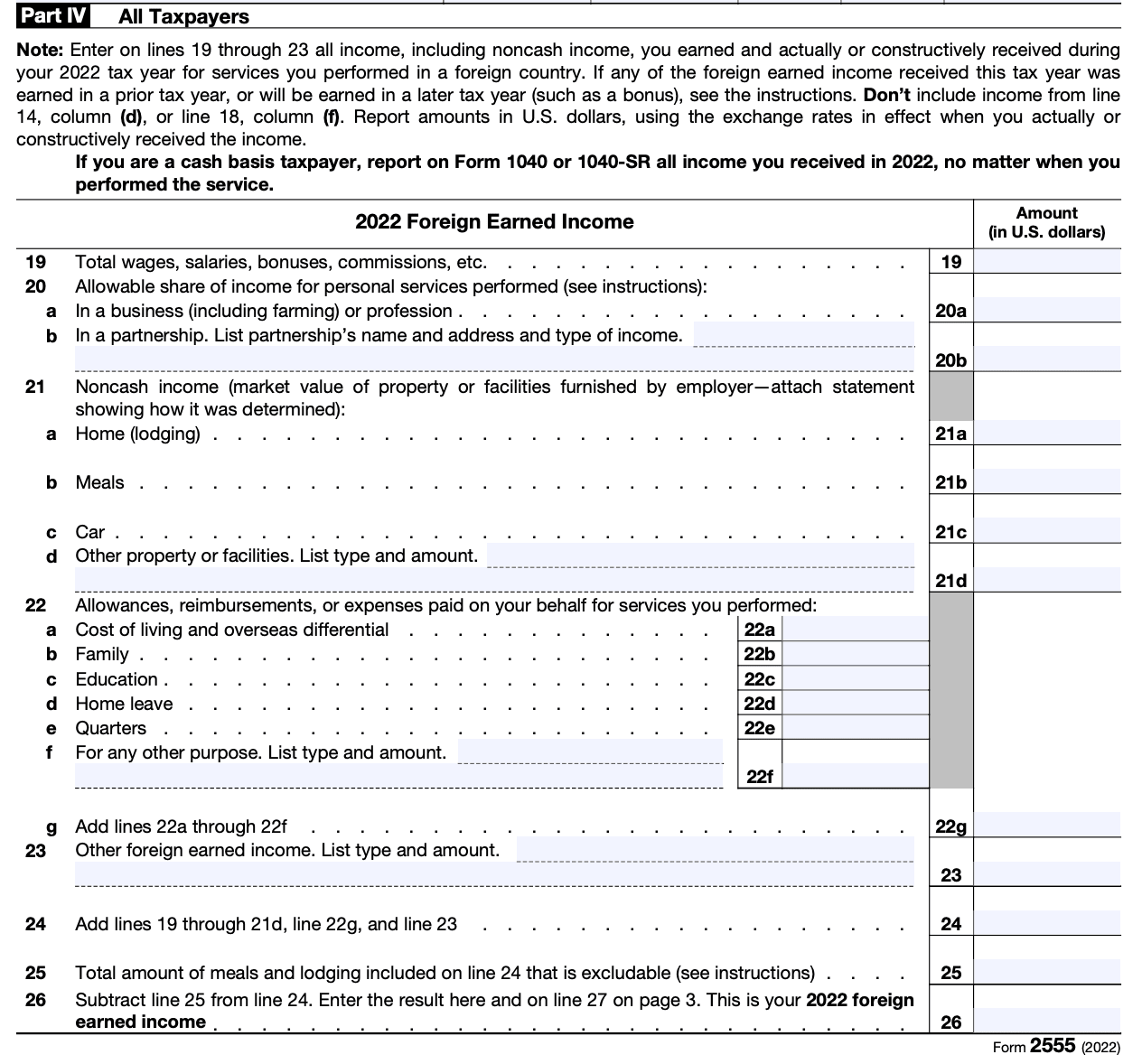

The international earned revenue exclusions, in some cases referred to as the Sec. 911 exclusions, omit tax on wages gained from working abroad. The exclusions consist of 2 parts - a revenue exclusion and a housing exclusion. The following Frequently asked questions go over the advantage of the exclusions consisting of when both spouses are expats in a basic way.

The smart Trick of Feie Calculator That Nobody is Discussing

The tax benefit excludes the earnings from tax at lower tax rates. Formerly, the exemptions "came off the top" reducing earnings subject to tax at the leading tax obligation prices.

These exemptions do not exempt the wages from US taxation but just give a tax decrease. Keep in mind that a bachelor functioning abroad for every one of 2025 that made about $145,000 with no other income will have taxed income lowered to zero - effectively the very same response as being "free of tax." The exemptions are calculated each day.